The Lingering Impact of

the Pandemic on IRS Collections

Jim Buttonow, CPA CITP

Updated on: September 14, 2023

At the beginning of the COVID pandemic in March 2020, the Internal Revenue Service appropriately stopped most enforcement with its People First Initiative. Like most businesses and organizations, the agency moved to remote work, causing a disruption in its ability to enforce compliance.

Most audits, field collection and automated compliance notices were halted so the IRS could focus on the massive effort of distributing rounds of stimulus payments. Remote work also meant return-processing backlogs. The IRS struggled to get back to normal operations as the backlog of unprocessed returns exceeded 35 million. During 2020-2022, the agency received an unprecedented number of phone calls, stifling its ability to return to compliance enforcement work.

There were some attempts by the IRS to re-engage its collection enforcement operations. The service restarted some collection enforcement in 2020 and 2021, with mostly Social Security and starting income tax refund levy notices and some reminder notices — but this enforcement was short-lived due to mounting service needs. In early 2022, IRS campus collection and non-filing compliance enforcement halted in favor of the IRS catching up on its backlog of returns and answering its phone lines. The IRS refocused its workforce in a surge effort to get back to normality.

Campus compliance functions were not the only areas affected by the pandemic. IRS field collection (i.e., its “revenue officers”) was also halted in March 2020 — but field collection gradually returned later that year. In 2020-2022, IRS field revenue officers were appropriately sensitive to individuals and businesses that were negatively impacted by the pandemic. As such, the IRS provided a great deal of discretion in using levy and lien actions on delinquent tax debtors.

IRS field collection gradually increased in 2022. Currently, with additional newly hired and trained revenue officers, field collection appears to be back to full capacity.

Overall, during the pandemic, the IRS rightfully put aside many of its enforcement functions in favor of helping taxpayers through the pandemic. To that end, there were tradeoffs in not enforcing collection during the pandemic. IRS data and changes to collection operations over the past four years show 10 clear lingering effects on post-pandemic IRS collection, which are detailed below.

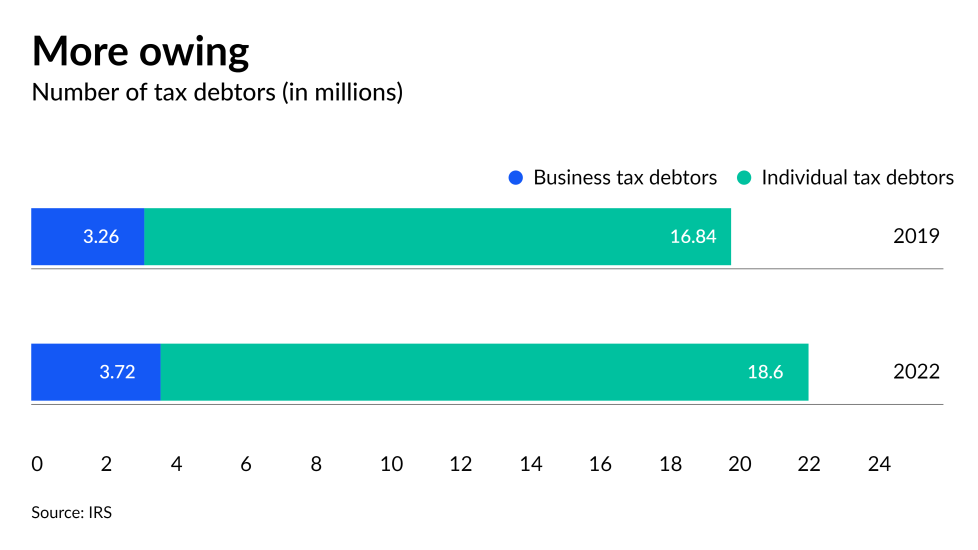

1. The number of tax debtors has increased

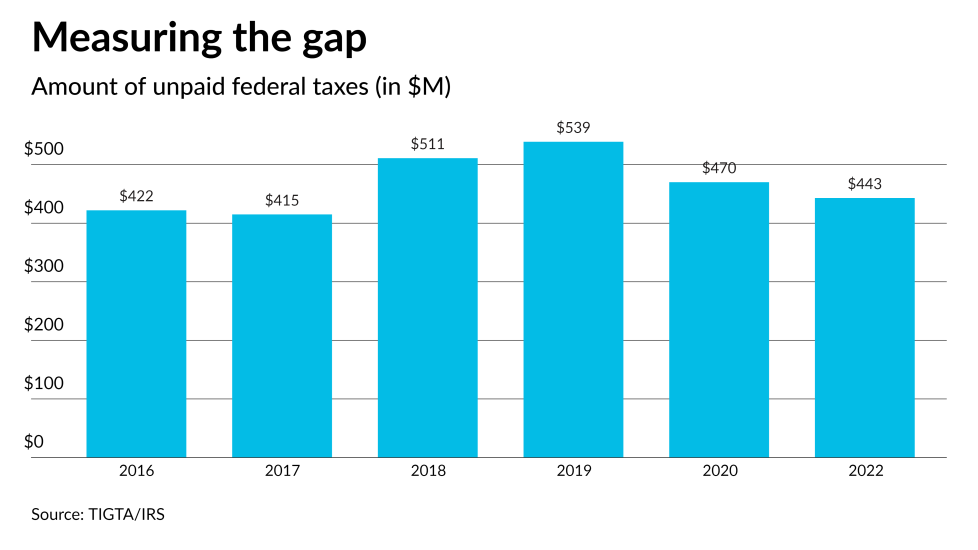

2. The amount owed still hovers around half a trillion dollars

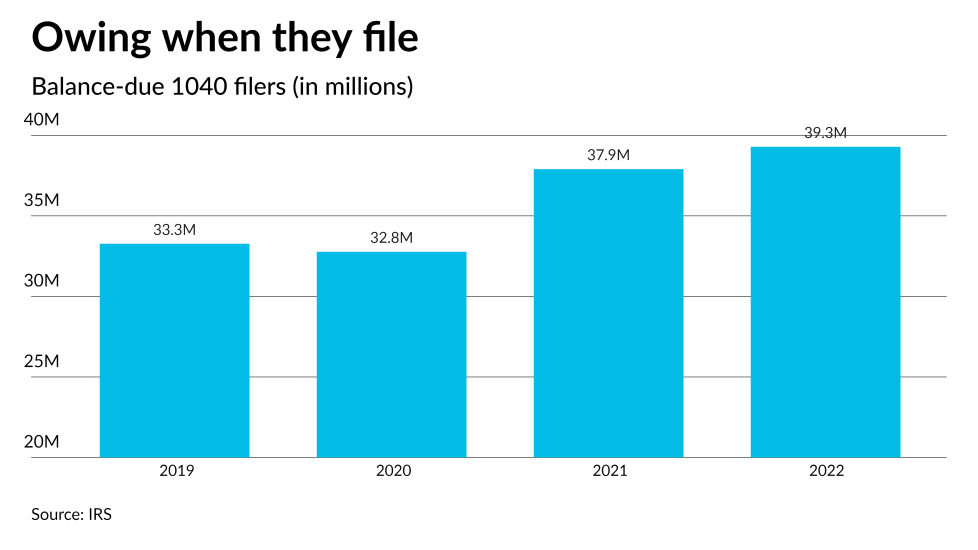

3. More are filing with a balance due

The lower 2023 filing season refunds give us some other data points to consider the potential causes of more taxpayers owing when they file. The average refund at the end of the tax season was down by over 7%. Pandemic-related tax benefits have been reduced and many taxpayers have not adjusted. Without future adjustments, the trend of more balance-due filers will stress IRS enforcement efforts further and add to the rolls of tax debtors.

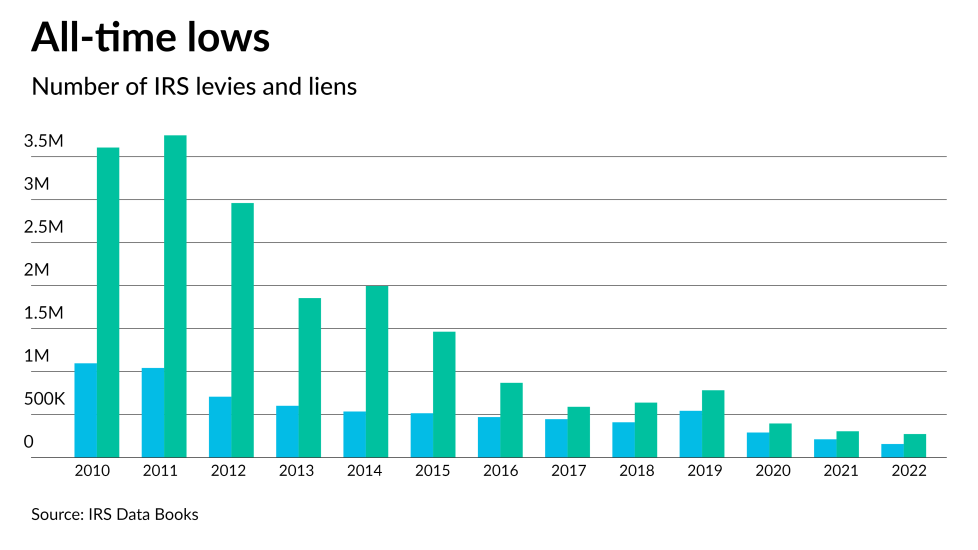

4. Liens and levies at an all-time low

Passport restrictions remain — but they are dependent on pre-requisite lien or levy compliance enforcement functions before restrictions are in place. Lien and levy activity has been limited — as such, the IRS ability to enforce collection through passport restrictions has been limited.

5. Non-filer enforcement has been almost non-existent

The IRS experienced resource issues before the pandemic that reduced its ability to pursue non-filers. In 2017 and 2018, the service temporarily halted its non-filer program in which it would file a return for the taxpayer if the taxpayer failed to do so after a number of notice requests (the “substitute for return” or SFR program). The IRS restarted the SFR program in 2020 but had to quickly halt it. In 2022, it issued only 178,218 non-filer inquiry notices.

How big is this problem? IRS data shows that the number of known non-filers through information returns (W-2s, 1099s, etc.) were over 11.3 million in 2022 — up from 7.9 million in 2021. However, in 2022, IRS non-filer investigations were well under 200,000 for the year.

This is only part of the story. The non-filer count does not include the potentially millions of unknown individual taxpayer non-filers who do not get 1099s or W-2s. Business non-filers are also a big unknown. IRS data shows the agency knows of tens of millions of potentially past-due business returns based on businesses with a filing requirement, but no return received.

IRS non-filer identification is about to be improved in 2024, giving the agency more information on small-business and gig economy non-filers. Starting in 2024, the IRS will have improved electronic payment tracking through lower thresholds for merchant card payments (PayPal, Zelle, Venmo, etc.) to file a Form 1099-K. The increase in Forms 1099-K in 2024 will likely identify and add to the number of known non-filers. The Form 1099-K will also help the IRS collect back taxes by identifying potential new levy sources.

6. Collection reminder notices are still on hold

The notice stream has gaps of time (usually around five weeks) before the next notice is issued. During the pandemic, the IRS only issued the required CP14 notice to most taxpayers — forgoing the reminder and collection notice from its ACS function. These notices have not resumed, resulting in no IRS campus compliance enforcement activity.

Many taxpayers pay when they receive a reminder notice. Without reminder notices, IRS campus collection enforcement is handcuffed and the service’s ability to collect by notice diminishes. The IRS has not provided any indication on when it will resume campus reminder notices.

7. An alarming number of taxpayers aren’t in an IRS agreement

8. High-income non-filers and tax debtors beware

Recently, the IRS announced that it made some progress against collecting from millionaire tax debtors with larger tax debts owed. However, data shows the agency has some work to do on those who owe higher tax debts. Agency data indicates the number of individual taxpayers who owe over $50,000 amounts to almost 1 million taxpayers. These individuals make up only 4% of tax debtors, but 64% of all individual debt owed and 45% of all unpaid taxes (when you include business taxpayers) to the IRS (a total of $202 billion in tax debt owed). The IRS also has over 3.7 million businesses who owe the IRS over $127 billion (29% of all tax debt owed to the U.S. Treasury).

Many of these high-income non-filers and debtors are the target of IRS field collection’s revenue officers.

Recently, the IRS announced it will no longer conduct unannounced visits of revenue officer to taxpayers. Pandemic-related scams, including IRS impersonation scams, necessitated the change to a more transparent collection process. Removing surprise visits will not improve IRS collection effectiveness but is a necessity, especially after a few years of pandemic-related scams.

9. OICs have declined

For the existing 22.3 million tax debtors, OICs are a rarely used option for back taxes owed. For 2022, the program was used by only 13,165 taxpayers.

10. Taxpayers are moving to self-service tools

As part of the Inflation Reduction Act, the IRS has committed to more online service options. For taxpayers, that means many more can self-serve when it comes to resolving a back tax balance issue. The IRS’s Online Payment Agreement, which allows a taxpayer to enter a payment plan if they owe up to $50,000 or an extension to pay if they owe up to $100,000, has exploded. OPA-originated payment plans are up 57% from 2019 to 2022 and are now the preferred method to obtain a payment plan.

More than 95% of individual taxpayers qualify to use an OPA to set up a payment plan. In 2022, more than 70% of all new payment plans were set up online. The IRS also plans to improve its online account in 2023 and 2024 to allow taxpayers to respond to notices and to enter into more agreements with the IRS on back balances owed.

What’s next?

The big question is when will the IRS resume collection reminder notices and collection and non-filer enforcement from its campuses. As of September 2023, reminder notices (CP501, CP503, and CP504 notices), collection notices (generally LT11 and other federal payment levy notices), and non-filer inquires (CP59s) are on hold. The IRS has stabilized its service and processing operations needed to provide support for restarting collection and non-filer notices. But campus collection notices are still on hold.

The second big question is the extent of IRS collection and non-filer enforcement once it turns back on its campus compliance functions. Most agree that any enforcement restart will be gradual. But there are also other related questions: What will be the impact of the new Inflation Reduction Act funding for collections and non-filer enforcement? Will the IRS have to change its original enforcement plans due to clawbacks of IRA 2022 funding from the Fiscal Responsibility Act in May 2023? Will the IRS only target wealthy taxpayers, or will collection and non-filing efforts impact all taxpayers?

The date the IRS returns to campus enforcement is not known. Once campus enforcement starts, taxpayers who are not in good standing face additional scrutiny and IRS deadlines before adverse actions start to occur. Getting started now on filing back returns and/or getting into an agreement with the IRS on past balances owed is the key to avoiding the pending and inevitable IRS enforcement.