10 Major Trends in IRS

Audits

Jim Buttonow, CPA CITP

Updated on: November 22, 2019

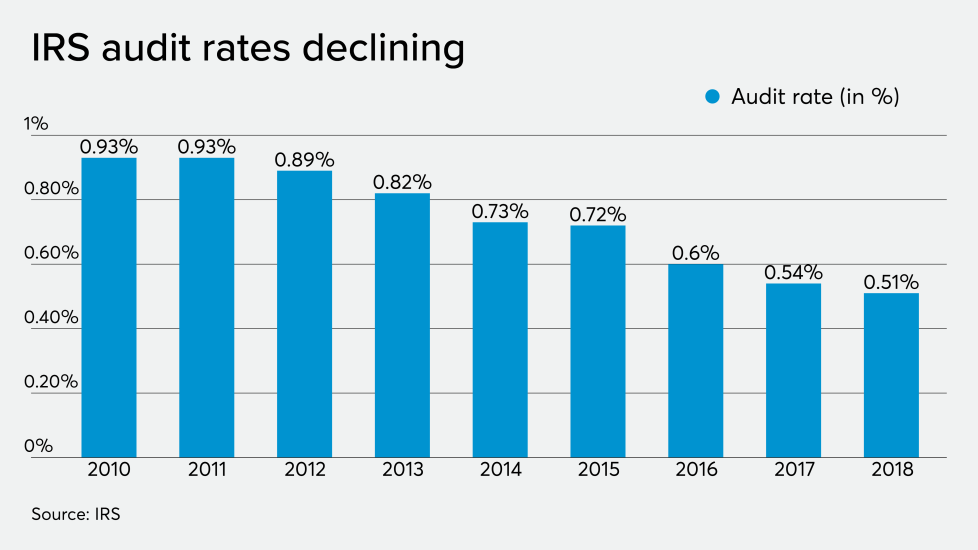

Most taxpayers envision Internal Revenue Service audits as intrusive investigations resulting in criminal sentences. Today, nothing could be farther than the truth: The IRS’s auditing power has been greatly diminished in the past decade. IRS audit resources have been reduced by 28 percent in the last decade and the audit rate has dropped from 0.9 percent in 2010 to 0.5 percent in 2018. In fact, the number of IRS audits in 2018 (991,168) dropped by almost half compared to 2010 (1.735 million).

Since 2010, the IRS has been tasked with doing more with less resources, but the reality is that the IRS cannot do more audits with less resources. The IRS audit data reveals 10 trends from the past decade that have become the new realities for current state of IRS audits.

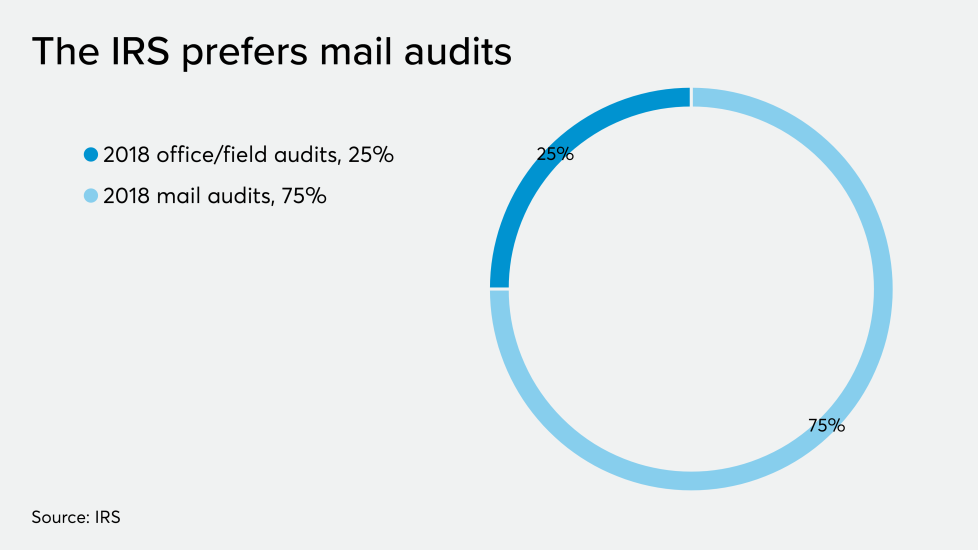

1. Most audits are done by mail

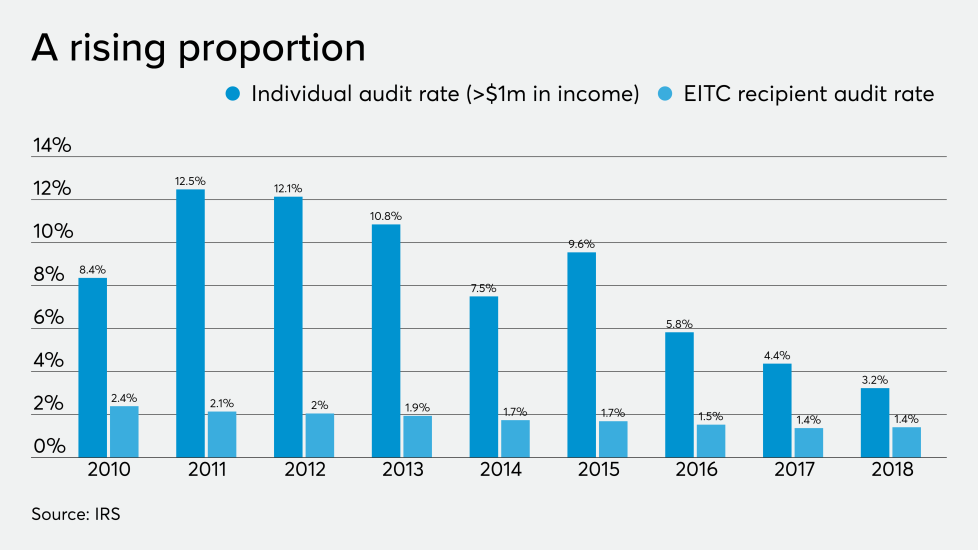

2. The main issue in audits: The EITC

3. An alarming amount of people do not respond to an audit

4. The most common IRS challenge to a return is not an audit

However, there is good news for taxpayers: Even the mostly automated underreporter process has been cut back due to lack of IRS resources.

5. The IRS knows who to audit

6. Field audits are rare, but expensive

7. Want your business to escape audit? Be an S corp or partnership

8. Audits on the wealthy are still popular, but have dropped

9. Audits have dropped, but penalties are still prevalent

10. Tax evasion prosecutions are low

Realities and the IRS ability to close the tax gap

As the fear of an audit motivator becomes less of a reality, the IRS must seek to simulate the audit by touching as many taxpayers as they can. For now, that looks like sending a lot of non-audit notices to taxpayers. Recently, the Treasury Inspector General for Tax Administration reported that the IRS sent over 219 million notices annually to taxpayers. In 2001, the number of notices sent was only 30 million. With the IRS’s current resources, the IRS notice may be the only means the IRS has to let taxpayers know that they are still there.