What the Tax Gap Tells Us

![rachadura[1] rachadura[1]](https://buttonowcpa.com/wp-content/uploads/elementor/thumbs/rachadura1-scaled-qyk3v9nixr87vpcz19h0mw8lrieol7gbzvjhnn0uh0.jpg)

Jim Buttonow, CPA CITP

Updated on: October 31, 2023

On Oct. 12, 2023, the Internal Revenue Service released the long-awaited, updated tax gap estimates. The tax gap measures how much the U.S. Treasury loses annually due to taxpayer non-compliance.

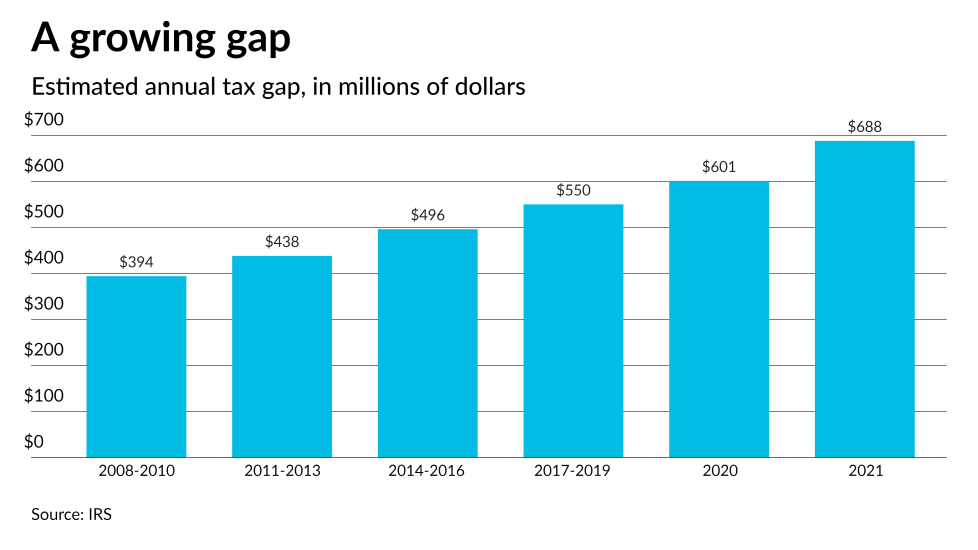

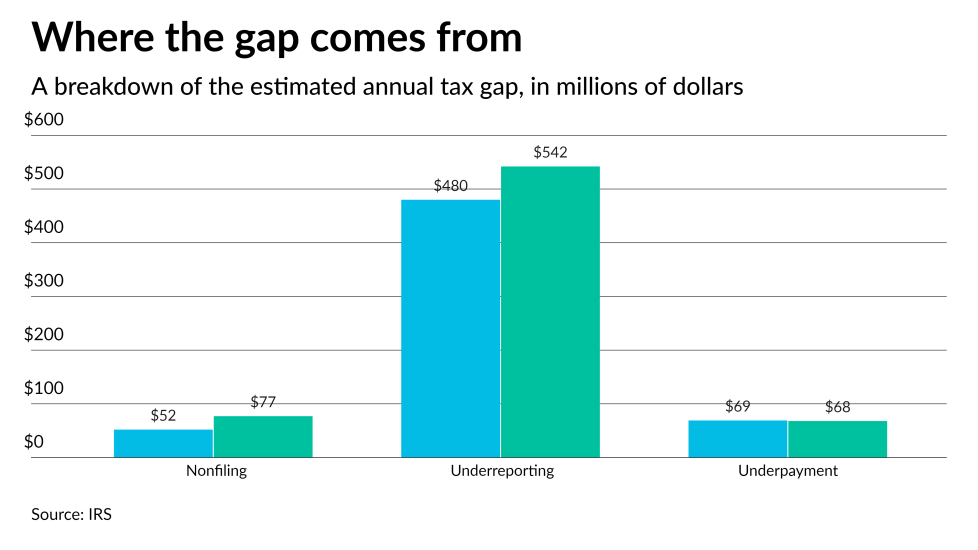

To no one’s surprise, the tax gap has risen since the last IRS study for the 2014-2016 tax years, and the service updated estimates for the 2017-2019 tax years. The most current figure, for tax year 2021, estimates a loss to the Treasury of $688 billion a year, comprised of the sum of these three components:

- Non-filing: $77 billion (from failure to file a required tax return);

- Underreporting: $542 billion (from inaccurate tax returns); and,

- Underpayment: $68 billion (from failure to pay taxes owed).

The tax gap has been a renewed focus of Congress in recent years, and tax gap estimates have been used as much of the rationale for additional IRS funding in the Inflation Reduction Act passed in August 2022. Details in the recent 24-page IRS Tax Gap Projections research study (IRS Publication 5869) provide a similar picture as prior tax gap studies and, arguably, support a more ramped-up IRS to improve compliance.

What’s next?

The tax gap provides the IRS strong data for both improved compliance programs on the one hand and service initiatives on the other. On the service side, the agency has been making much progress in the past year. It exceeded its 85% phone level of service goal in the 2023 tax season and is rapidly advancing its online account help. It plans more progress in 2023 and 2024 with new business online accounts and enhancements to the tax pro online account.

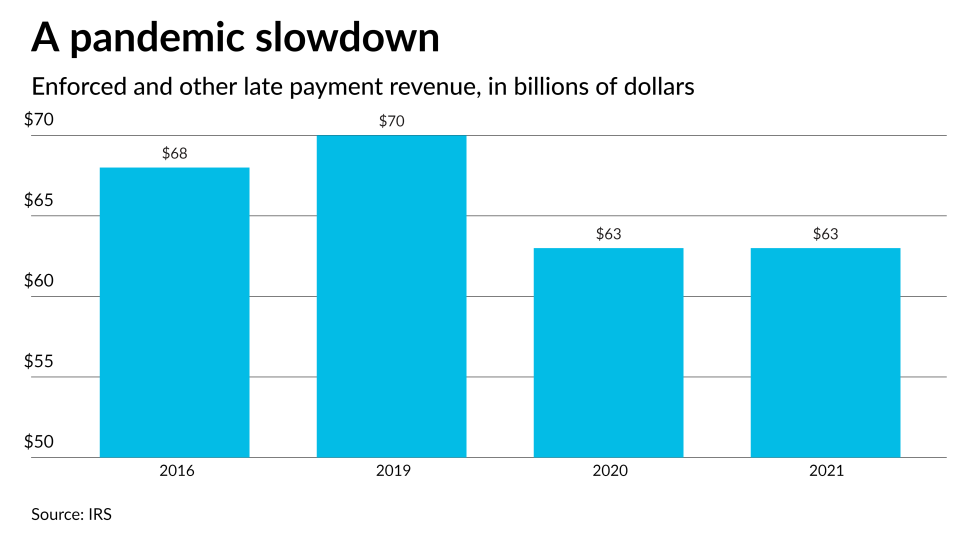

But compliance enforcement has been slow to return. Since the beginning of the COVID-19 pandemic in March 2020, much of compliance enforcement has been on hold. In 2022, the service returned its local field collection and examination functions to be fully operational. And both functions have been actively growing through aggressive hiring efforts.

But local enforcement is only a very small part of overall compliance enforcement. Most of the heavy lifting is not done locally, but rather in its “campuses,” which until recently sent millions of notices each year to taxpayers questioning the accuracy of their returns, asking for payments on late balances, and inquiring about non-filing. In these functions, the IRS is still very much on hold. Its automated underreporter unit (CP2000) has maintained a limited presence during the pandemic but is far from the volume of notices that it reached in 2011 and 2012.

The conclusions from the recent tax gap study support the IRS increasing its compliance presence and turning back on notice systems. Taxpayers must know that the tax agency is present. Continuing to hold off campus enforcement may fuel a different tax gap estimate when the service measures it next year.

The six tax gap data points below will bolster calls for a well-resourced IRS:

1. It’s probably bigger than estimated

- The international tax gap;

- Illegal activity;

- Corporate income tax; and,

- Cryptocurrency and other digital asset non-compliance.

Another example is flow-through entities (i.e., S corporations and partnerships). The IRS also notes that its non-compliance projections for the over 10 million flow-through entities are likely not accurate. However, in 2023, the IRS is aggressively pursuing complex partnerships as audit targets.

The bottom line: The current estimate is only a fraction of the true tax gap, and the IRS knows it.

2. Non-filing is a growing problem

The IRS has deprioritized non-filer compliance in recent years. Since 2017, the service’s efforts to pursue non-filers have dropped significantly. During the pandemic, return backlogs hindered the IRS from sending non-filing inquiries to taxpayers (in short, it is difficult to send non-filer inquiries when the agency hasn’t processed all the returns it has received). In 2022, the service identified 11.3 million individual taxpayers, through information returns such as Forms W-2 and 1099, who did not file despite having income requiring them to file a return. Despite the fact that 11 million returns represented 7% of all individual returns filed in 2022, the IRS sent only 178,218 notices to taxpayers asking them to file.

The growing number of balance-due filers has also added to the non-filing epidemic. Many of these taxpayers take the wrong path to not filing a return to avoid or defer payment. For the first time, non-filing issues now surpass underpayment in total tax gap losses.

3. The IRS will need to target small business

The 2021 tax gap estimates continue to validate that small business has significant non-compliance. The Committee for a Responsible Federal Budget has highlighted past tax gap studies and shown that over half of the underreporting tax gap is related to small business. The 2021 projections suggest significant small-business non-compliance and provide a similar conclusion.

Small-business non-compliance is clearly shown in the underreporting tax gap estimates. Out of the $542 billion in projected 2021 underreporting, $271 billion, or 50%, relates to small business:

- Individual business income tax: $182 billion;

- Small corporation income tax: $21 billion; and,

- Self-employment tax: $68 billion.

4. New 1099-K reporting should help

Enter the new Form 1099-K reporting rules. In 2023, third-party payment processors such as PayPal and Venmo, and other gig-economy-enabled applications like Uber and AirBnB are required to report all payments over $600 to recipients. This initiative, if it survives both administrative and legislative pushback, will be a big new tool for IRS compliance enforcement. The IRS will have more data to match returns for underreporting, as well as be able to detect more non-filers that previously went under their radar. The service will also have these income sources to use as potential levy sources when a taxpayer owes the IRS.

Form 1099-K compliance measures are not new. How will the IRS modify its old compliance programs with this information? And how will it ensure that taxpayers are not overreporting income? That remains to be seen — but one thing is clear: The IRS has a strong new weapon to close the tax gap.

5. Voluntary compliance may be headed for a downturn

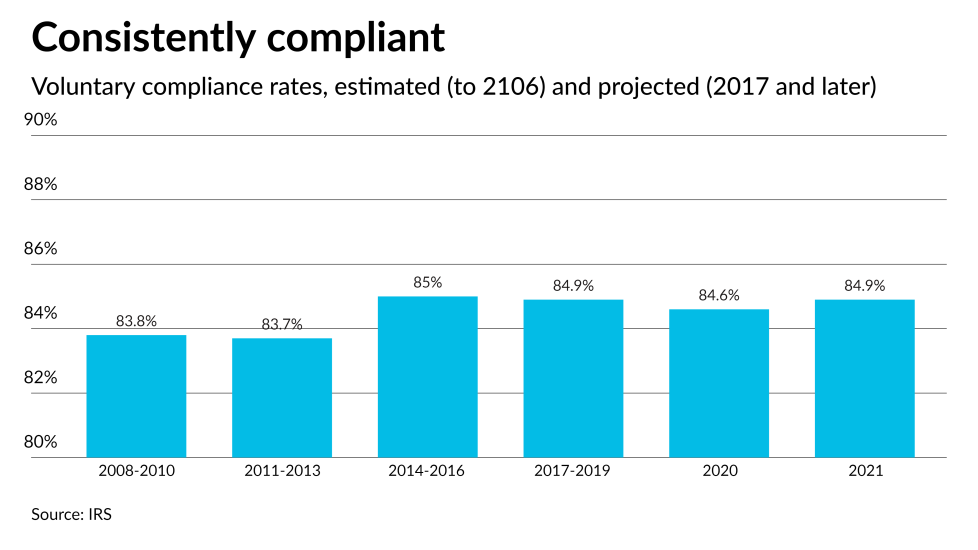

Taxpayer voluntary compliance is measured in the tax gap as the “voluntary compliance rate.” Over time, the tax gap has been in the range of 82-85%. The most recent study shows the VCR at the higher range of 84.9%.

It is important to note that small changes in the VCR can mean big dollars to the Treasury. In 2021, a 1% increase in the VCR represents $49 billion in additional taxes paid.

But what motivates taxpayers to voluntarily comply? IRS surveys may shed some light. The primary factor for voluntary compliance, according to taxpayers, is their willingness to do what is right. However, just behind those numbers are actions that show the IRS is present — including enforced compliance. Fear of an audit and information return matching show up high in all Taxpayer Attitude Surveys.

The reality is that voluntary taxpayer compliance and enforced compliance work hand-in-hand. But the 2021 tax gap voluntary compliance data may not be fully reflective of recent lack of compliance enforcement and notices on the VCR. IRS presence was felt by almost all taxpayers in 2020 and 2021, which may have provided a short-term elevation of the VCR. In both these years, almost all taxpayers received an IRS notice to provide them information about stimulus payments. Fast forward to 2023: What will be the effect of all-time lows in IRS audit rates and not pursuing non-filers and tax debtors? We will find out in upcoming tax gap estimates.

6. The wrong direction for enforcement revenue

The slight drop in IRS compliance enforcement revenue should be expected — but it is not the direction the service wants to see. Many taxpayers may have falsely felt the presence of the IRS during the pandemic because almost all taxpayers received an IRS notice. Did the presence of the IRS contribute to more taxpayers paying? Perhaps the enforcement revenue during the pandemic validates that just the presence of the agency and potential enforcement may be a driver to compliance. What is clear is that the IRS needs to reverse the decline in enforcement revenue. In 2023, mass notices to the non-compliant have been on hold. More robust year-round compliance enforcement process and restarting of campus compliance notices should soon follow to begin to reverse this alarming trend.